Child identity theft, part 2: How to reclaim your child’s identity

In a world where children as young as a single day old can fall prey to fraud, it is more important than ever to educate parents and other caretakers about the dangers of child identity theft. While the hope is that perceptions can be changed and criminals brought to justice, likely the biggest concern for parents is how to reclaim their child’s identity, should they ever be in such an unfortunate position.

That is, unless the parents or guardians are the ones behind the fraud in the first place. In part 1 of our series on child identity theft, we talked about familiar fraud—fraud committed by someone who personally knows the victim—and how children are increasingly being targeted for this crime. We also touched on the repercussions of familiar fraud in the lives of kids and their families.

In part 2 of our series, we look at turning back the tables and reclaiming your child’s identity, whether it’s been stolen by a stranger or someone who knows them. In addition, we highlight the signs your child’s information might be compromised and how parents or guardians can better protect their data.

Signs of child identity compromise

When it comes to figuring out if a child’s identity has been compromised and is being used, thankfully, there are telltale signs that parents and guardians can look out for. These signs are displayed both in the real world and the digital world. They include:

- Physical mail arriving to your home that is addressed to your child. These include card applications, banking statements, and credit card or insurance applications for accounts under their name, and they’re the most obvious sign of compromise. Your child may also receive a notice from the IRS either because of unpaid income taxes or having multiple tax returns filed under their SSN.

- Phone calls received from collection agencies directed to your child.

- If the landline has a caller ID, your child’s name may appear on it. This indicates that someone has stolen and is misusing their information.

- A turned-down application for government benefit for your child. This is because someone with the same SSN as your child may already be benefiting from it.

- Bank turning down an account application for a child due to the negative credit score associated with the child’s SSN.

- Important documents of your child suddenly going missing, including their SSD card and birth certificate.

- In addition, the Identity Theft Resource Center (ITRC) has listed several documents that may suddenly show up—or, in certain cases, not show up—that potentially give away active ID theft activity.

How to reclaim your child’s identity

Reclaiming a stolen identity takes a lot of work. This is true whether the victim is an adult or a child. And the length of time spent undoing the harm to your child’s reputation potentially correlates with how long the fraud has been taking place before it was identified and acted upon.

If you, dear parent or guardian, have seen any of the telltale signs of identity fraud, immediately contact the top credit bureaus to freeze your child’s credit until they are old enough to enter into a contract. Doing so means that these reports will be taken out of circulation.

A credit report for a child is normally non-existent, but if one is found, the parent or guardian should contact an organization that deals with child identity theft, such as the Identity Theft Report. If a parent would only like to take extra precaution, they can ask their credit reporting agencies (CRA), which are Experian, Equifax, TransUnion, or other smaller bureaus to create their child’s credit report and freeze it.

It is equally important for parents and/or guardians to keep the PIN that each of these credit unions have assigned to them.

Beyond freezing and receiving credit reports, other important steps for reclaiming your child’s identity include:

- Contacting any companies where fraudulent accounts in your child’s name were opened. Tell the fraud department about what happened, and ask them to close the account and send a letter confirming your child isn’t liable. If necessary, send a letter explaining your child is a minor who can’t enter into contracts and attach a copy of their birth certificate.

- For parents in the United States, contacting the Federal Trade Commission (FTC) at IdentityTheft.gov or call 877-ID-THEFT to report the fraud.

How to protect your child’s identity

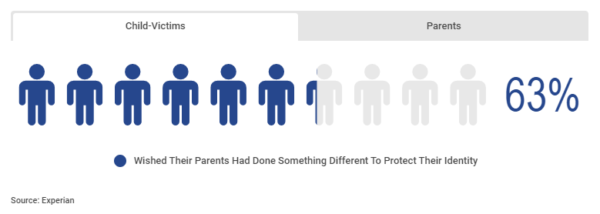

In the Experian survey report mentioned in part 1 of our series, more than half of victims (63 percent) wished that their parents had done more to protect them from potential fraud. Interestingly, 61 percent of parents felt the same way.

Awareness of the risks and underlying dangers of child identity theft is something parents should be actively practicing. To avoid opening an opportunity for fraudsters to take advantage of your child’s information, here are some tips:

- Don’t carry your child’s SSN card. There is no need—keep it safe at home instead.

- Know when your child’s SSN is really needed when applying for something on their behalf. Schools, for example, don’t ask for a child’s SSN, so there is no need to provide it.

- When throwing out mail or documents with your personal information or your child’s, shred them before disposing.

- You may also want to consider getting your child another form of identification, such as a passport or a state identification card.

- If you receive news of your child’s school getting breached, don’t hesitate to call the school and ask for more information.

- Inquire about your child’s school directory information policy. A directory information contains a lot of personally identifiable information (PII) about a child. And sometimes, such information is shared outside of the school. Parents and/or guardians can either inform the school that they shouldn’t share their child’s information without their expressed consent, or opt out of having their information shared.

- Keep all important documents of your child in a safe and secure place.

Early detection is key. Getting acquainted with the red flags and keeping an eye out for them would nip fraud in the bud. Not only that, it’d make reclaiming and restoring a child’s identity back a little easier—emotionally, mentally, and financially.

Half of Experian respondents with children who have been victimized by fraud have learned the hard way not to share personal information with family. Some have also started actively checking credit scores and enrolling for identity theft protection services.

The things we leave behind

It’s easy for adults to forget that, like them, children have data and information that needs protecting, too. And even if their children are too young to use a computing device, they still have digital footprints. The reason? Mom and Dad or other legal guardians leave them behind. Unfortunately, it is unavoidable.

Mom needs to schedule a doctor’s appointment for the little one’s check-up, so she uses her healthcare app. Proud dad shares short clips of his bundle of joy with Aunt Martha, who lives far away and couldn’t visit the newborn in hospital. And before all of this, Mom and Dad announced the pregnancy to all their social media channels.

Sadly, the very activities that give us joy and make tasks convenient can also leave behind breadcrumbs that identity thieves can sniff out and follow. Rarely do parents or guardians stop to think about how their sharing can impact their child’s digital life.

Take, for example, baby pictures you may have shared on social media. They may contain metadata pointing to the location where they were taken. Or when you made that public announcement about your baby on the way: Did you also reveal their name? Fraudsters can easily glean from this information the baby’s full name and location. If they don’t have the child’s SSN yet, they can easily pair it with another SSN to create a synthetic identity.

This isn’t to say that parents and/or guardians should deprive relatives and friends of your little one’s adorable moments, or avoid entering any of their children’s information online. Just be mindful when doing so. Share privately by making use of your social network’s privacy settings. Also caution or remind your relatives and friends to avoid re-sharing media you post to others without your consent.

We’re all in this together

In this age of data breaches, it is easy for us to focus on the security of our own data. But let us be aware that kids and young adults are becoming more of a target, too. Children, especially, are blank slates—a highly-prized quality for someone with access to their information and with malicious intent. Hackers are after them; yet often, it’s those that are closer to them who cause the greatest harm—sometimes without knowing they are doing it. Worse, more than one person could be fraudulently using an innocent child’s identity.

While parents and guardians are advised to be equally vigilant in protecting the data of their children—biological and adopted ones—as much as their own or anyone else’s, we encourage any other responsible adult in the family to take part. If familiar fraud becomes a family problem, it should be a family affair to thwart it off at all costs for the future of the most vulnerable in the household.

The post Child identity theft, part 2: How to reclaim your child’s identity appeared first on Malwarebytes Labs.